Carry Back Nols 2025 Carry Back. Prior to the tax cuts and jobs act (tcja), taxpayers could carry back nols for two years and carry them forward 20 years. They can also carry forward any remaining nol indefinitely until it's used up.

Can nols be carried back? Here’s an overview of those changes.

Carry Back Nols 2025 Carry Back Images References :

Source: www.slideserve.com

Source: www.slideserve.com

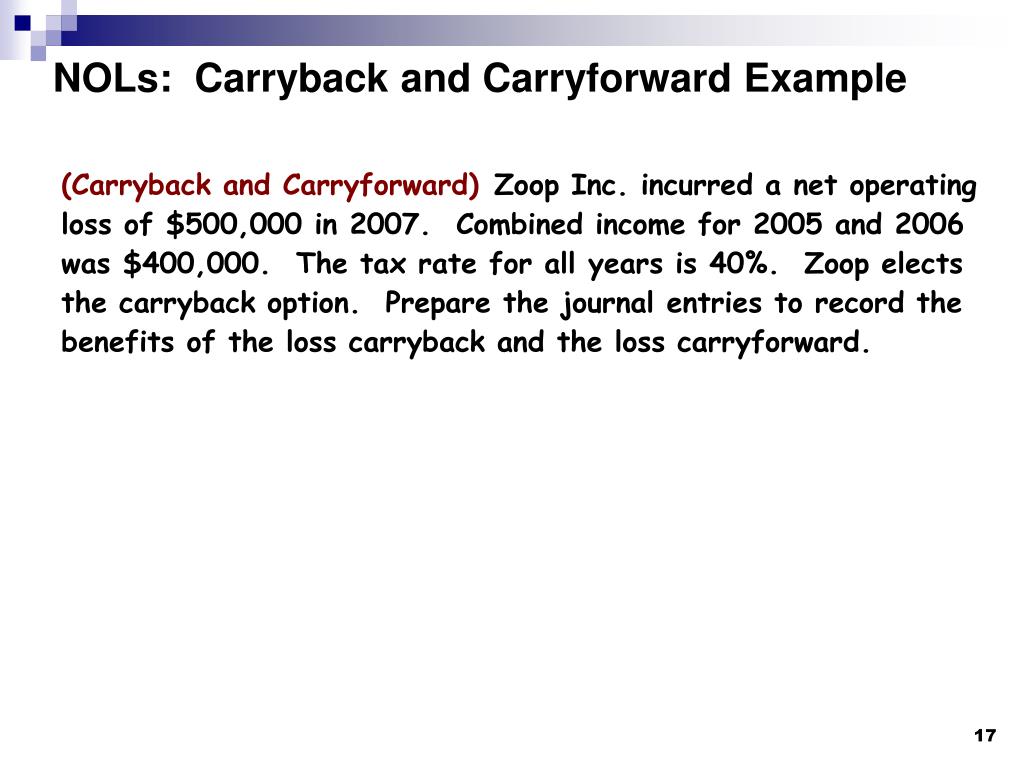

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, $25,000 of the nol is from nonfarming.

Source: www.slideserve.com

Source: www.slideserve.com

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, In the u.s., a net.

Source: www.slideserve.com

Source: www.slideserve.com

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, Beginning in 2018, taxpayers are no longer able to carry back nols, but instead, may carry forward nols for an unlimited number.

Source: www.universalcpareview.com

Source: www.universalcpareview.com

Can a C corporation Carryback NOL’s? Universal CPA Review, The cares act allows taxpayers to carry back nols arising in taxable years beginning in 2018, 2019, and 2020 to the five preceding taxable years.

Source: www.slideserve.com

Source: www.slideserve.com

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, $25,000 of the nol is from nonfarming.

Source: windes.com

Source: windes.com

Guidance on NOL Carryback Under CARES Act Windes, While some countries do allow for indefinite loss carryovers, others have time limits.

Source: www.may-firm.com

Source: www.may-firm.com

Importance of NOL Carryback and What It Means to Businesses Harold, Before tcja, c corporations could carry nols back for two years and carry them forward for 20.

Source: www.nolcarryback.com

Source: www.nolcarryback.com

NOL Carryback CARES Act Implications Nol Carry Back, They also could apply nols against 100% of their.

Source: www.nolcarryback.com

Source: www.nolcarryback.com

Understanding the Difference Between Carry Back and Carry Forward Nol, You can choose to waive the.

Source: slideplayer.com

Source: slideplayer.com

Patty Fulton Jennifer Breeden ppt download, The cares act allows taxpayers to carry back nols arising in taxable years beginning in 2018, 2019, and 2020 to the five preceding taxable years.

2025