Oklahoma Tax Brackets 2025. Census bureau) number of cities that have local income taxes: Here's the remaining schedule, round by round:

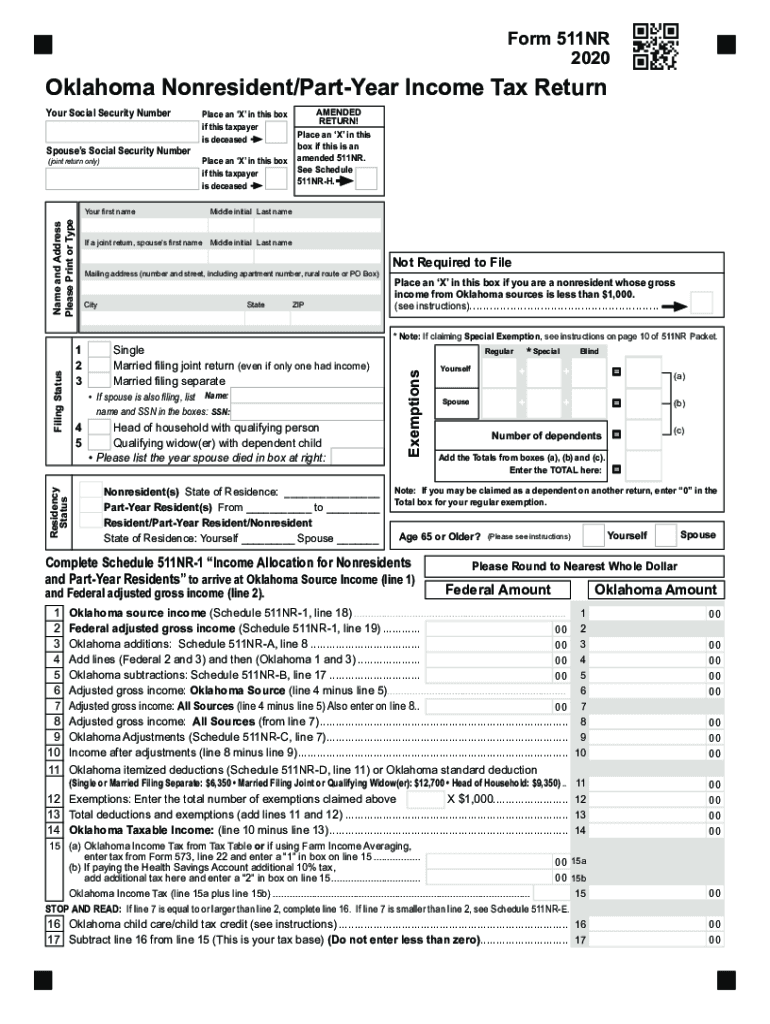

Oklahoma tax commission publishes 2025 income tax withholding tables. * this column must also be used by a qualified widow(er).

The Oklahoma Tax Calculator Is For The 2025 Tax Year Which Means You Can Use It For Estimating Your 2025 Tax Return In Oklahoma, The Calculator Allows You To Calculate.

Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

• Instructions For Completing The Oklahoma Resident Income Tax Return Form.

Here’s the remaining schedule, round by round:

Total Pension Obligations For The State Of Oklahoma As Of July 1, 2022, Are $47,964,176,035 With Actuarial Value Of Assets At $39,691,819,308 For A Funding Status Of 82.8% And An.

Images References :

Source: www.signnow.com

Source: www.signnow.com

Oklahoma Tax 20222024 Form Fill Out and Sign Printable PDF Template, March 19, 20244 min read by: For married couples filing jointly, the standard deduction will increase from $25,900 to $27,700 in 2025.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2025 2023 Printable Calendar, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in oklahoma. The top marginal income tax.

Source: printableformsfree.com

Source: printableformsfree.com

Irs Tax Brackets 2023 Chart Printable Forms Free Online, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Through 5 shall be calculated as if all income were earned in oklahoma.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023 And 2025, What is the federal income tax? Kevin stitt shakes hands with house speaker charles mccall, while sen.

Source: lizbethzcristy.pages.dev

Source: lizbethzcristy.pages.dev

New For 2025 Taxes Teri Abigael, That worked out well for that select group. The annual salary calculator is updated with the latest income tax rates in oklahoma for 2025 and is a great.

Source: www.athenscpa.net

Source: www.athenscpa.net

Tax Brackets Explained Seymour & Perry, LLC Athens CPA, This tool is freely available and is designed to help you accurately estimate your 2025 tax return. What is the income tax?

Source: www.dochub.com

Source: www.dochub.com

Oklahoma tax forms 2021 Fill out & sign online DocHub, Marginal federal income tax rate. Oklahoma’s 2025 withholding methods were released nov.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, Pro tempore greg treat looks on (far left). Census bureau) number of cities that have local income taxes:

Source: neswblogs.com

Source: neswblogs.com

2021 Vs 2022 Tax Brackets Latest News Update, Oklahoma’s 2025 withholding methods were released nov. 2025 individual income tax rate by state.

Source: itep.org

Source: itep.org

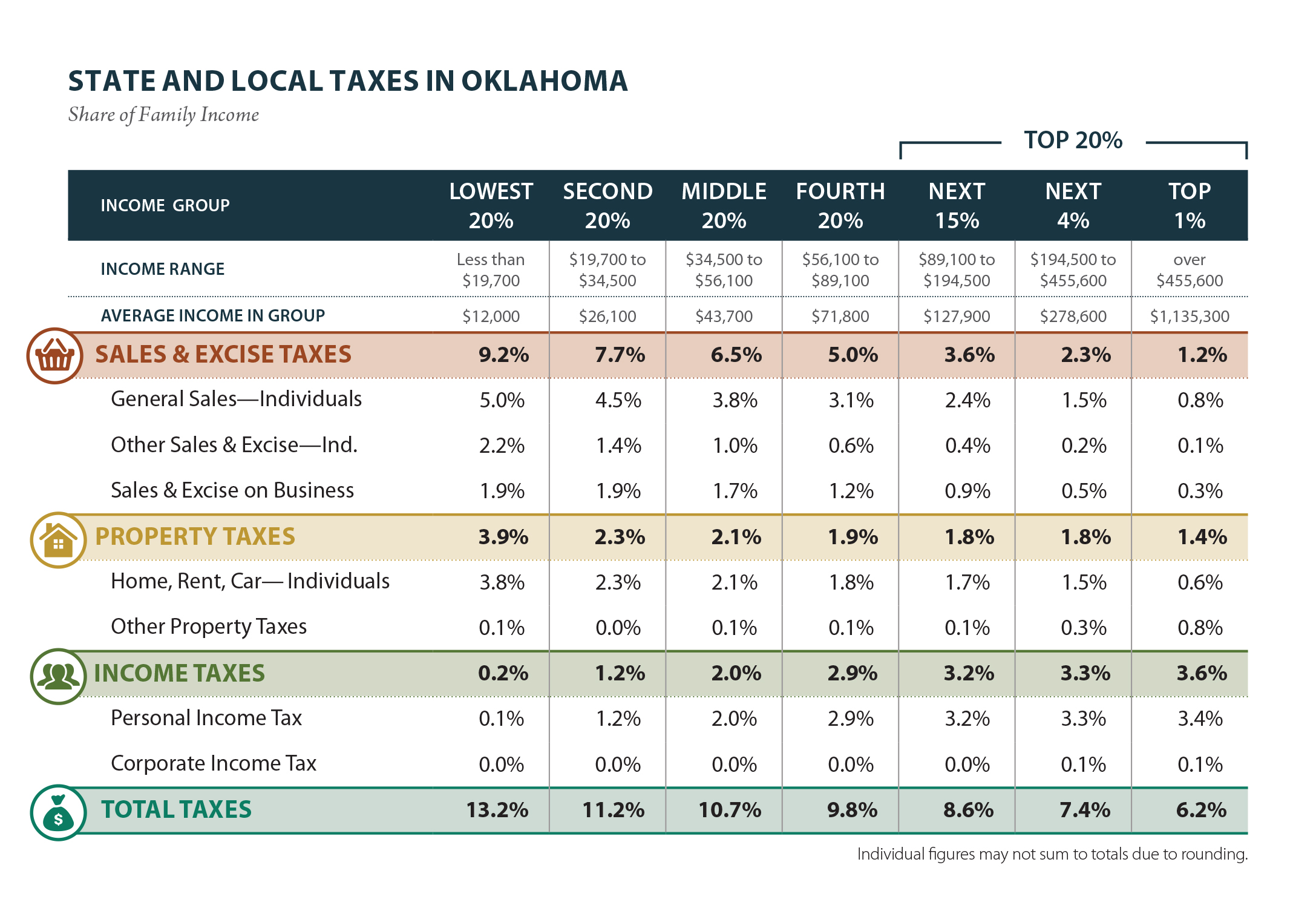

Oklahoma Who Pays? 6th Edition ITEP, Kevin stitt shakes hands with house speaker charles mccall, while sen. For married couples filing jointly, the standard deduction will increase from $25,900 to $27,700 in 2025.

Economic Nexus Treatment By State, 2025.

Pro tempore greg treat looks on (far left).

Here's The Remaining Schedule, Round By Round:

Aga estimates show that american adults will legally wager $2.72b on the 2025 men’s and women’s tournaments, equivalent to 2.2% of the total handle legally.